Don't Miss Out on Australia's Best Investment Locations

Property Investment Research Made Faster, Consistent and More Effective

Creators featured in

Property Investment Research Made Faster, Consistent and More Effective

Creators featured in

You're Just Seconds Away from Find The Best Growth Suburbs

Don't worry, We won't spam you

Risk comes from not knowing what you're doing.

Warren Buffett

For property investors or budding home buyers: if you want to buy in a suburb that is showing potential for capital growth then LocationScore is a must for you.

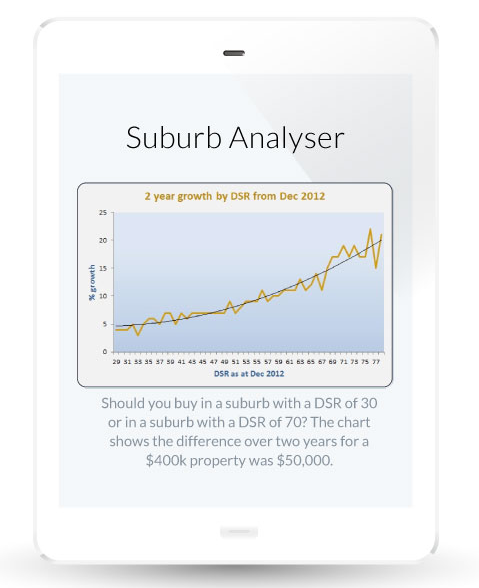

LocationScore is a leading edge property-research platform that interprets big data to analyse and score every suburb in Australia. It scores each suburb, on a monthly basis, out of 100 (houses and units are scored separately), using eight key indicators that measure the level of supply and demand.

One of the fundamental laws of economics that determines the price of all goods and services is supply and demand. They are fluctuating states that work together, counterbalancing the other should it rise or fall.

The question is: what indicators can you measure to track the level of supply and demand in the property market?

There are a lot of potential variables to consider when assessing supply and demand, such as: population growth, economic activity, and infrastructure development. Wanting to unscramble the puzzle, we started our analysis in 2010 and identified 8 broad indicators that had a clear correlation between price growth and levels where demand exceeded supply.

The score found for each suburb isn't just about combining all the 8 indicators-there is theory behind it. Each one of the indicators has a different level of impact on the property market and so LocationScore uses a secret weighting within its algorithm to produce it s scores.

We Only Send You Awesome Stuff

It goes without saying that any property buyer would get lot of comfort and confidence knowing they are buying in a location with strong prospects for capital growth.

LocationScore helps locate the ‘better’ suburbs—those that indicate demand for that area is stronger than current property-supply levels. Such an imbalance raises the potential for short-term capital growth! It makes for a very good location to start searching for a property indeed.

Property Investors

Mortgage Brokers & Insurers

Property Investment Advisers

Home Buyers

Accountants

Buyers Agents

Real Estate Agents

Financial Planners

Property Managers

Property Researchers

Risk Analysts

Insurance Providers

Banks/Lenders

Valuers

Sellers/Vendors

Ben McInnes

I have procrastinated over my next investment purchase for some time and having access to LocationScore has given me confidence in my chosen suburb and I have just signed the contract today.

Daniel Gardner

The use of LocationScore has added another tool to the property search tool belt. It has become an essential part of the trade taking plenty of time out to the research process by providing valid, accurate and up to date information to assist in making informed decisions. It is the first port of call when researching an area and takes the leg work out of the research process.

Kip Laverack

Love the website. It's quick and easy to use and navigate. When researching a property, rather than manually search each individual detail about a suburb, LocationScore wraps it all together on one page which allows you to decide whether to investigate the suburb further or move onto the next. Look forward to more valuable information to come.

Ben Adamson

Location Score is the cure for paralysis by analysis! It allows me to refine my shortlist of suburbs and focus more time on the suburbs with the best growth potential. Thank-you Location Lads for bringing a sophisticated yet affordable tool to the market.

Buyers Agent

Co-host of The Property Couch

Podcast

Co-host of Location Location

Location Australia

Qualified Property Investment

Advisor

Co-host of The Property Couch

Podcast

Chair of PIPA

LocationScore was developed out of a 'meeting-of-minds' when Ben Kingsley and Bryce Holdaway sat down and started to compare their property research notes and findings regarding capital growth drivers.

"When we sat down to compare theories and observations, it was very clear we had a lot of common theories with regards to the indicators and variables we were all monitoring to detect possible areas for future capital growth and a lot of them were based on demand and supply activity within the market,” says Ben. The property market is made up of thousands of markets within markets, and at any one time, the vast majority of markets are not showing the demand-to-supply imbalance that we look for when searching for capital growth. It's these suburbs that one should avoid buying in. Instead, using LocationScore, which scans over 15,000 suburbs on a monthly basis and then scores them out of 100, subscribers have a competitive advantage in fast-tracking their research to only a select few locations.

That's a huge time saver for one, but more importantly, buying in a superior location vastly increases the potential for superior capital value increases if they buy well within that suburb.

Suburb Analyser Search & Reporting - Houses

15,000 suburbs Analysed for House (monthly)

Top 250 Fast Track Filter – National

Suburb Analyser Search & Reporting - Units

15,000 suburbs Analysed for Units (monthly)

Top 250 Fast Track Filter – By State or Territory

Top 250 Fast Track Filter – By Capital Cities

This browser is not supported, please upgrade to one of the following browsers.

( Chrome , Edge , Firefox , and Safari for MacOS users )

© Location Score Pty Ltd ALl Rights Reserved | Terms and Conditions and Privacy Policy