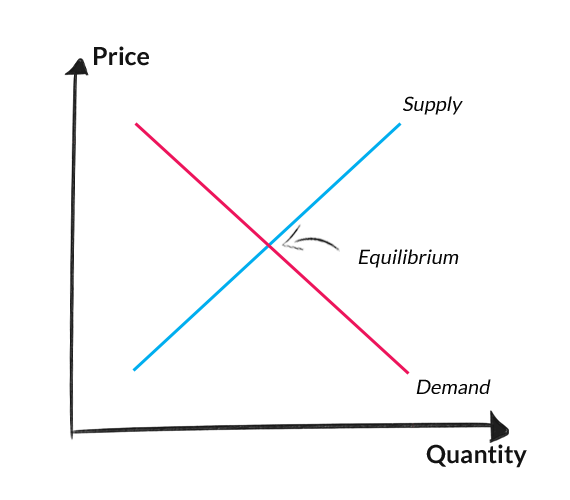

Property prices tend to rise when demand exceeds supply.

There is not enough 'good pie' to go around, so people start to pay a premium for that delicious 'beachside' pie. Generally speaking in an economy there are many macro measures all designed to get a 'read' on the performance of the economy. The same can be said for property too, there are countless variables influencing demand and supply: from the arrival of new stock, local economic fluctuations, new infrastructure, interstate and overseas migration all needing somwhere to live etc. Through LocationScore's own research we have identified 8 indicators that when combined

show a strong relationship to price growth when the LocationScore is higher than average.